STL TechWeek 2025

REGISTER FOR TECHWEEK EVENTS

Countdown to TechWeek

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

OUR FINTECH TRACK LEADERS

KEYNOTE SPEAKER

CONFERENCE PRESENTERS

Adam Maher

Founder & CEO, Ursa Space Systems Inc.

Anthony Calamito

Vice President & Co-Founder, GEO261

Bradley Harris

Senior Sales Engineer, Snowflake

Brett Lord-Castillo

Geospatial Core Squad Lead, Bayer Crop Science

Brevard Nelson

Managing Director, Caribbean Ideas Synapse

Chaitanya Rahalkar

Software Security Engineer, Block

Ed Morrissey

Co-Owner, Chief Strategy Officer at Integrity

Jason Hammond

VP, Business Partner Manager, Fidelity Private Shares

Jeromey Farmer

Head of Data & AI, Americas - Strategy & Consulting at Avanade/Accenture; Professor of Practice & Academic Director at Washington University

Justin Bennett

Principal Consultant & Co-Founder, Pinnacle Business Strategies, LLC

Mitch Farsad, CAMS, CFE, CFCS

Anti-Money Laundering Director for the Financial Intelligence Unit (FIU) Department, Stifel Financial Corp.

Ron Branstetter

Crypto Influencer, Developer and Founder, Unicorn Fart Dust $UFD

Teja Swaroop Mylavarapu

Lead Software Engineer, Capital One

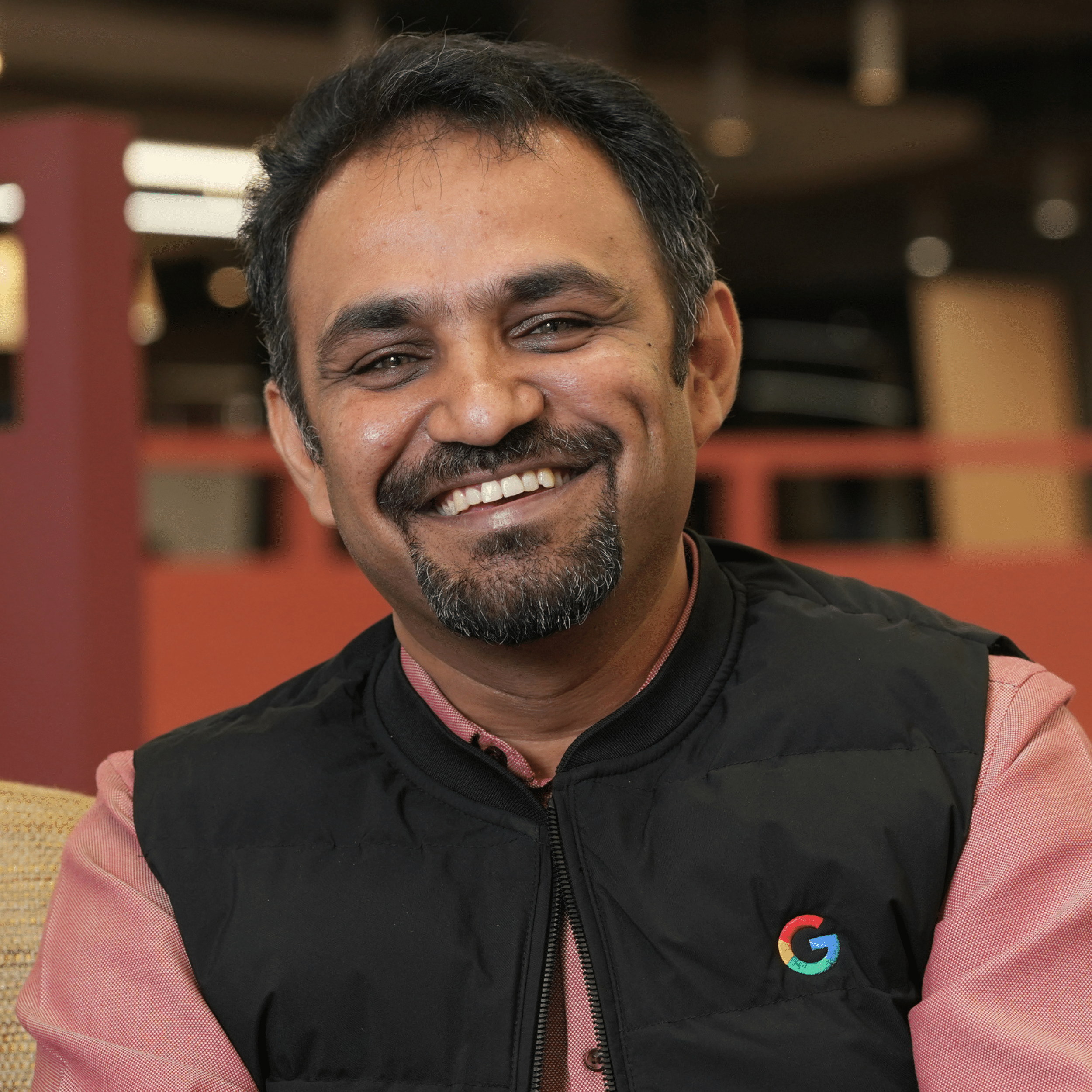

Vijaykumar Jangamashetti (VJ)

Senior Google Cloud Consulting Architect, Google

Doors Open & Registration

Opening Keynote: Unleashing the Power of Data and Generative AI for Fintech

Main StageKick off the St. Louis Fintech Summit with an electrifying Opening Keynote by Vijaykumar Jangamashetti (VJ), a seasoned cloud consulting architect and trusted advisor at Google, as he unpacks the game-changing potential of Generative AI in financial technology and beyond. With 17 years of expertise in data analytics, cloud computing, and AI—and as an 11X GCP-certified professional—VJ will guide you through Google Cloud's revolutionary GenAI technology, focusing on Gemini's capabilities for Google Cloud, Vertex AI Suite includes Foundation Models, Model Garden, Vertex AI Agent Builder, and Vertex AI Search & Conversion. This high-impact keynote will feature live demonstrations of Gemini-powered multimodal experiences on Vertex AI, explore real-world fintech use cases, and provide insights into Gemini code assist for developers and enterprises. Whether you're navigating AI-driven fraud detection, optimizing financial models, or transforming customer experiences, this keynote will set the stage for an innovation-packed summit.

Key Trends within e-Commerce

Main StageWhether you are exploring modernizing your B2B e-commerce platform, maximizing your existing e-commerce conversions or you are a fintech start-up trying to find your position within the market, this presentation will highlight relevant trends impacting e-commerce today. From AI to crypto to social commerce to augmented reality to buy now, pay later (BNPL) financing options, this presentation will briefly highlight the key trends occurring today that impact all of us.

Intelligent and Predictive Failover - The Race Against Errors

Main StageToday, we all live in Interconnected Systems where one Service has multiple dependencies on other Services. Any downtime on any of these downstream Services/endpoints impacts the Upstream Services causing severe Customer impact. What if we have an Intelligent mechanism to monitor and react without developer intervention? Can we predict the failures & react proactively? Solution: Intelligent & Predictive Failover is a solution which identifies errors & failures even before the actual Customer request. It intelligently Clusters the Services & applies Proactive Monitoring with failover predictability. I will be talking about Intelligent tracking of anomalies with deep health checks & latency based region detection for traffic failover & failback, their alarm config management, threshold based error handling & etc. The focus will be on how to predict failures, reduce customer impact & learn from pervious patterns for future failures.

Lunch

Track A - ChatGPT in Financial Crimes Investigations: Use Cases, Query Optimization, and Best Practices

Main StageIn the evolving landscape of financial crimes investigations, AI-powered tools like ChatGPT are transforming how analysts detect, analyze, and mitigate financial threats. This workshop, led by Mitch Farsad, Director of the Financial Intelligence Unit (FIU) at Stifel Financial, offers a beginner-friendly, hands-on guide to integrating ChatGPT into financial crimes investigations. Participants will explore real-world use cases where AI enhances investigative workflows, uncover tips for optimizing queries to improve analytical outputs, and learn best practices for safely leveraging AI while maintaining compliance with regulatory frameworks. The session will also cover critical safety measures, ethical considerations, and limitations to be aware of when incorporating ChatGPT into financial intelligence analysis.

Track B - Revolutionizing Financial Inclusion: How FinTech and AI Empower Growth in Emerging Markets

Front ClassroomDiscover how the convergence of FinTech and artificial intelligence is reshaping financial inclusion and driving growth in emerging markets. In this session, Brevard Nelson, a seasoned entrepreneur and FinTech expert, explores innovative strategies and technologies that break down barriers to financial access. Learn how AI-powered solutions are creating opportunities for underserved populations, enabling businesses to thrive, and fostering economic transformation. Gain actionable insights into how these trends can be leveraged for global impact and competitive advantage in the digital economy.

Track A - Preparing for your Next Round: Cap Tables, Valuations and Fundraising Best Practices

Front ClassroomAs you gear up for your next funding round, having a clear, accurate, and well-managed cap table is critical to securing investor confidence and maximizing your valuation. This workshop dives into fundraising best practices, valuation strategies, and how to streamline equity management to position your company for success. We'll explore the evolution of Shoobx—the equity management platform designed to make fundraising less painful and more efficient—and its recent acquisition by Fidelity, now operating as Fidelity Private Shares. Learn how startups have leveraged Shoobx’s comprehensive workflow automation to manage equity, fundraising, HR, board governance, and stockholder activity—all in one platform—in collaboration with their attorneys.

Track B - Spatial Finance: The Future of Geospatial-Informed Investment & Risk Management (Panel)

Main StageAs financial markets become increasingly complex, the integration of geospatial technology and financial analytics—Spatial Finance— is transforming how institutions assess risk, allocate capital, and drive investment strategies. This panel at the St. Louis Fintech Summit will explore the cutting-edge convergence of geospatial intelligence (GIS) and fintech, highlighting its impact on financial decision-making, climate risk assessment, supply chain resilience, and economic forecasting. Industry experts, fintech innovators, and geospatial analysts will discuss how satellite imagery, AI-powered mapping, and real-time location data are being leveraged to enhance credit risk analysis, optimize investment portfolios, and improve financial inclusion strategies. The session will also address key challenges, including data privacy, regulatory considerations, and the ethical implications of geospatial financial modeling. Join us for a forward-thinking discussion on how Spatial Finance is reshaping the future of financial services, providing deeper insights into market behaviors, environmental risks, and global economic trends. Whether you’re a fintech leader, investor, or policymaker, this panel will equip you with the knowledge to stay ahead in the rapidly evolving data economy.

Track A - The Linguistics of Large Language Models: What Your AI's Mistakes Reveal

Front ClassroomWhen GPT-4 writes "I'll send you the attachment later" (without any ability to send attachments) or ChatGPT claims it can "see" an image that isn't there, what's really happening? This talk dives into the fascinating patterns of AI hallucinations, exploring how linguistic analysis of AI errors provides unique insights into how these models actually work. Through live examples, we'll examine common patterns of LLM mistakes and what they reveal about the underlying architecture and limitations of current AI systems. Key Points: 1. Common patterns in AI hallucinations and their linguistic roots 2. The disconnect between capability claims and actual abilities 3. How context windows influence AI behavior 4. Understanding prompt injection through linguistic analysis 5. Real-world examples of AI linguistic patterns 6. What these patterns tell us about future AI development

Startup World Cup - Fintech Pitch Competition

Main StageTrack A - Using Streamlit, Snowflake's Document AI and RAG to Enhance Customer Experiences

Front ClassroomBy utilizing RAG (Retrieval Augmented Generation), we can reduce hallucinations and "ground" a model response by making a set of relevant documents available to the LLM as the context to a question's response. This session will give a brief overview of how RAG works and then show how we can utilize the information contained outside of our database in unstructured documents (PDFs) to increase our confidence in our LLM's response. We will walk through the ingestion of these documents and the retrieval of relevant sections for use in a custom Streamlit application for use by our customer support team, financial advisors, or analysts.

Track B - Unicorn Fart Dust: The $60m Memecoin from Chesterfield's Ron Branstetter

Main StageRon Branstetter didn’t expect to profit from crypto. The Chesterfield father of two had always put his faith in physical capital, like gold and silver, which he would talk about daily on his YouTube channel, Rons Basement. But as the crypto market rose over the years, he became curious enough to experiment in the space. After watching a short how-to video, he got a crypto wallet, invested $100 and developed a new memecoin he named Unicorn Fart Dust. He posted about his “experiment” on YouTube, and 48 hours later, Unicorn Fart Dust reached a $240 million market cap. Now valued at $60 million with more than 40,000 Unicorn Fart Dust holders, UFD is an active online community of fans across the world who have named themselves “dusters.” They connect with each other by creating NFTs, memes, videos, music and artwork. Join us for a fireside chat with Founder, Ron Branstetter on the state of Crypto and what he is seeing shift within the industry.

Track C - Using GeoAI and Space Observation to Predict Financial Markets

Paperboat GalleryIn the world of alternative data, satellite imagery has long been recognized by the financial community as a valuable resource, though widespread adoption has been hindered by technical barriers. Historically, use cases were limited— most notably, by counting cars in retail parking lots to generate trading signals for equities. Today, the landscape has shifted. Satellite data is more abundant, offering higher revisit rates and diverse imaging types, including electro-optical, radar, and thermal. Instead of getting lost in a sea of possibilities, end users can rely on the 'orchestration' expertise of companies that manage the behind-the-scenes steps needed to deliver data in a usable format. In an era of heightened uncertainty—driven by trade policies and geopolitical shifts—this wealth of data is becoming an essential tool for monitoring economic activity from space. Traders and portfolio managers can use satellite data to test their investment hypotheses on key topics, such as the state of commodity demand, the strength of industrial output, and the pace of construction.